5 Long-Term Financial Goals and How to Achieve Them

Success

FEBRUARY 13, 2024

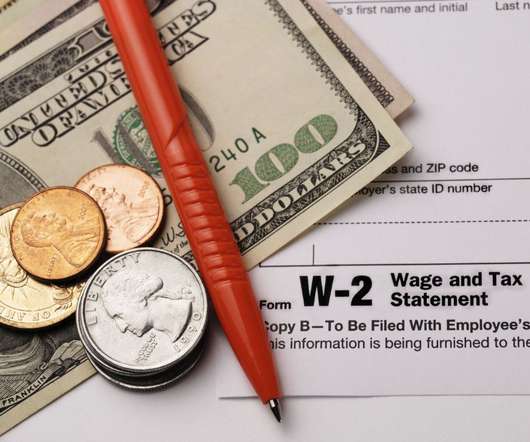

The timeline of a long-term goal generally isn’t strict, giving you plenty of time to review and adjust your goals as you go. Save for retirement Expected time: 10-35 years Account types: Retirement plans including IRAs, 401(k)s and pensions Planning for retirement is one of the most common long-term financial goals.

Let's personalize your content