Making Taxes Less Taxing

Success

SEPTEMBER 27, 2024

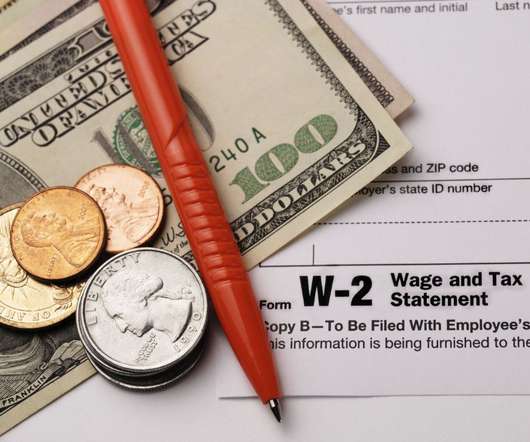

For example, viewing your taxes as a time-consuming duty to check off your list will make it seem like a chore. Lee lists the following benefits of doing your taxes: You may discover expenses that have been billed twice by mistake. You can determine expenses to cut. “How you frame doing taxes [is what] really matters,” Lee says.

Let's personalize your content